Marketing and Empathy Psychology

Multi-State Tax Issues for Payroll

By - Patrick A. Haggerty, EA

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- 06 Aug - 21 Oct 2022

- 10:00 - 12:00

- October 7, 2025 | 1:00 pm (EST) |

- 60 Mins

Managing payroll across state lines is one of the most complex—and high-risk—compliance challenges for today’s employers. Whether your business operates in multiple states, has employees who relocate or telecommute, or employs remote staff living in one state and working in another, multi-state tax rules can quickly become a legal and financial minefield.

This practical, fast-paced webinar will help you cut through the confusion. You’ll learn how to determine which states require tax withholding, where to report wages and unemployment taxes, how to navigate reciprocal agreements, and what red flags could trigger audits or penalties.

Whether you manage payroll in-house or work with service providers, this session is packed with real-world strategies, actionable guidance, and compliance essentials you can’t afford to miss.

Why You Should Attend

- Understand how an employee’s location or movement creates nexus for your business—and what that means for tax obligations.

- Learn how to determine state income tax withholding when employees live and work in different states.

- Gain clarity on unemployment tax rules across state lines—and how to avoid double taxation or penalties.

- Navigate reciprocal agreements, nonresident certificates, and local tax nuances with confidence.

- Learn how telecommuting, relocation, and remote work affect your payroll tax responsibilities.

- Avoid costly errors, including under-withholding, incorrect filings, and SUTA dumping traps.

Key Topics Covered

- Multi-state tax withholding: General rules vs. special cases

- Reciprocal agreements: What they are and when they apply

- Tax residency vs. domicile and its impact on payroll

- State/local withholding certificates vs. federal W-4

- How supplemental wages are treated across different states

- Multi-state unemployment tax: Allocation and compliance

- SUTA dumping explained—and how to stay compliant

- Fringe benefit taxation: State differences you need to know

- Nexus implications of remote and traveling employees

- Payroll tax consequences of hiring military spouses and telecommuters

- How to avoid common state payroll tax mistakes and penalties

Who Should Attend

- Payroll Managers and Supervisors

- Payroll Service Providers and Consultants

- Tax Compliance Officers

- Public Accountants and Internal Auditors

- Enrolled Agents and Tax Preparers

- HR and Benefits Administrators

- CFOs and Finance Managers with payroll oversight

Vulputate eros arcu magnis donec sem pretium scelerisque a etiam. Eros aliquam elit si mattis phasellus at orci letius ligula posuere. Sodales maecenas facilisis diam egestas dictumst si fames mus fermentum conubia curabitur. Ornare nisi consectetur semper justo faucibus eget erat velit rhoncus morbi.

Speaker Detail

Patrick A. Haggerty, EA

Pat Haggerty is a tax practitioner, author, and educator. His work experience includes non-profit organization management, banking, manufacturing accounting, and tax practice. He began teaching accounting at the college level in 1988. He is licensed as an Enrolled Agent by the U. S. Treasury to represent taxpayers at all administrative levels of the IRS and is a Certified Management Accountant. He has written numerous articles and a monthly question and answer column for payroll publications. In addition, he regularly develops and presents webinars and presentations on a variety of topics including Payroll tax issues, FLSA compliance, information returns, and accounting.

Webinar Information

- Duration : 60 Mins

- Date / Time(EST) : October 7, 2025 | 1:00 pm

- 06 Aug - 21 Oct 2022

- 10:00 - 12:00

- Jakarta, Indonesia

Share this event

Related products

-

Management Skills for New Managers

$299.00 – $399.00 Select options -

Avoiding Costly Mistakes: Expert Guide to Handling Payroll Overpayments in 2024

$249.00 – $399.00 Select options -

The DOL Predicts that the Overtime Rule would be Launched in April 2024! Employers Need to Prepare for Compliance!

$199.00 – $349.00 Select options -

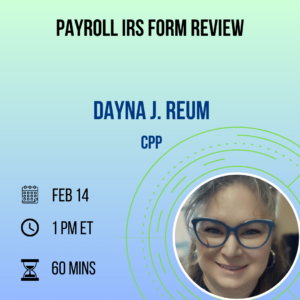

Payroll IRS Form Review

$199.00 – $349.00 Select options