Marketing and Empathy Psychology

Navigating 1031 and 1035 Exchanges With Confidence

By - Steven Mercatante

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- 06 Aug - 21 Oct 2022

- 10:00 - 12:00

- March 19, 2026 | 1:00 pm (EST) |

- 100 Mins

Like-kind exchanges under IRC Sections 1031 and 1035 remain powerful tax-deferral tools—but only when executed correctly. As the IRS continues to refine information reporting and compliance expectations, even experienced professionals face increased risk of missteps, penalties, and audit exposure.

This practical, update-driven webinar provides clear guidance on how to navigate today’s rules governing 1031 and 1035 exchanges. Designed for professionals who advise on or process these transactions, the session focuses on what qualifies, what must be reported, and where common errors occur. You’ll gain clarity on recent regulatory developments, timing requirements, and documentation expectations that directly impact compliance.

Rather than theory, this webinar emphasizes real-world application—helping you distinguish between taxable and reportable transactions, manage partial exchanges, and determine when a 1035 exchange is appropriate versus when alternative strategies should be considered. You’ll leave better prepared to advise clients, structure compliant exchanges, and reduce unnecessary tax exposure.

Key Takeaways:

- Stay current on IRS updates affecting 1031 and 1035 exchanges

- Apply best practices for managing like-kind exchange compliance

- Distinguish taxable events from reportable exchanges to reduce audit risk

- Properly defer gains on qualified property transactions

- Understand how partial exchanges are treated under current IRS guidance

- Identify exceptions to reporting requirements for specific property sales

- Determine which properties, contracts, and transactions qualify

- Meet critical timing and procedural requirements for 1031 exchanges

- Recognize when a 1035 exchange is appropriate—and when other strategies may be more effective

This webinar equips you with the practical tools and clarity needed to confidently manage like-kind exchanges in today’s evolving compliance environment.

Who Should Attend:

This session is ideal for professionals involved in advising, preparing, or reviewing like-kind exchange transactions, including:

- Tax professionals and CPAs

- Financial and real estate advisors

- Tax preparers and compliance officers

- Professionals handling real estate or insurance policy exchanges

Vulputate eros arcu magnis donec sem pretium scelerisque a etiam. Eros aliquam elit si mattis phasellus at orci letius ligula posuere. Sodales maecenas facilisis diam egestas dictumst si fames mus fermentum conubia curabitur. Ornare nisi consectetur semper justo faucibus eget erat velit rhoncus morbi.

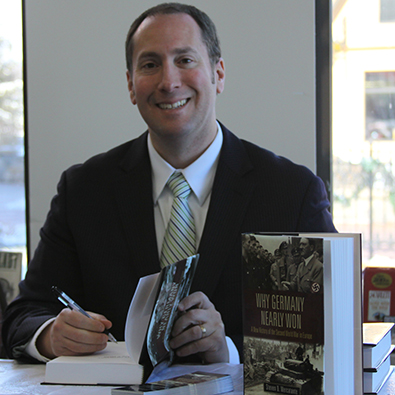

Speaker Detail

Steven Mercatante

Steven Mercatante is the principal and founder of TIR Consulting, LLC. He is a nationally recognized leader in tax reporting education and consulting on specialized compliance issues. He has conducted on-site consultation for corporate clients from across the world and led countless seminars and webinars for Convey Compliance Systems, IAPP, Balance Consulting, The Accounts Payable Network, Accounts Payable Now and Tomorrow, Progressive Business Conferences, The Center For Competitive Management, and more. He is also a published author, with numerous articles published on tax and financial law, and he has authored and published a series of tax guides on topics such as: W-9/1099 & W-8/1042-S compliance and reporting, payment cards, U.S. State & Local Reporting, worker compensation issues, international tax compliance, and more.

Webinar Information

- Duration : 100 Mins

- Date / Time(EST) : March 19, 2026 | 1:00 pm

- 06 Aug - 21 Oct 2022

- 10:00 - 12:00

- Jakarta, Indonesia

Share this event

Related products

-

Management Skills for New Managers

$299.00 – $399.00 Select options -

The DOL Has Launched Their Salary Threshold Law for July 1, 2024! Employers Need to Prepare for Compliance!

$199.00 – $349.00 Select options -

2024 Independent Contract Rule by DOL Has Become a Deadline for March 11, 2024! Audits by Department of Labor (DOL) and the National Labor Relation Board (NLRB) are Creating Havoc for Employers!

$199.00 – $349.00 Select options -

Legal & Ethical Challenges for Employers: An Increase In Burnout, Stress, & Mental Illness

$199.00 – $349.00 Select options